Today's post is Part One of a two-parter on the Federal Budget. Part One will just be a general overview of the federal budget, what it is, who's responsible for it, its size, and its scope. Part Two will involve a more detailed breakdown of the Budgets components.

Remember to visit Economystified again on 12/23, when I'll be posting the Part Two! The exciting conclusion of "The Federal Budget - FY 2012"!! But for today, let's just get started with a bit of an overview:

The Federal Budget - FY 2012

(Part One of Two)

The Federal Government's budget has become a really hot issue these last few years - I feel more so than usual. Between Occupy Wall Street, the Tea Party, the Debt Ceiling Crisis, and the presidential hopefuls' high profile economic/taxation reform talking points, opinions on our government’s spending habits are suddenly quite en vogue.

But the debate is a hard one to follow as long as "The Budget" remains the ephemeral, alluded-to-only entity that it often is. We hear a lot of numbers and percents thrown around. But without a good handle on those figure’s context, their "informativeness” is completely lost.

With no understanding of the structure, size and composition of the Budget itself, it’s impossible to form an educated and salient opinion on the Budget, or how it should be handled or changed.

In this two-post series, I'm going to break down the Fiscal Year 2012 Federal Budget for you, piece by piece, to help you develop a basic - but still actionable - understanding of the nation's baseline financial position.

Part One (which is this post) will be a general overview of the Federal Budget. In the next post (which will go up on 12/23), I'll provide a little more detail on the individual items that the Budget contains.

My hope is that if you know how the US Federal Government spends (and where their spending money is coming from), you'll feel a little more comfortable (maybe even interested!) following the public discussion about the nation's finances.

Before we begin…

There's just three things I want you to keep in mind:

1) These two posts will concern only the US FEDERAL GOVERNMENT’S BUDGET. They will have nothing to do with the budget of your state or city. They will not reflect on the way US citizens spend their own money, or the behaviors of employers and producers. They will have only to do with the spending of the Federal Government itself.

The Fed's expenditures in no way, shape or form constitute "our economy." Our economy is the sum of all financial/monetary/economic activities in the country. The Fed's spending patterns are only a component of that bigger picture.

In fact there's a good chance that the Federal Budget actually has less of a direct tangible effect on your day-to-day life than the economic activity of your city, employer, family or neighbor.

However, whenever the Federal Government borrows or spends money, they do so in the name of the US. So their bills are the US's bills. Their debts are the US's debts. When it comes to financing, the Federal Government is THE State.

Moreover, the Fed’s Budget is what everyone's transfixed with at the moment. Whenever you hear “THE Budget" mentioned in the news, this is the one they’re probably talking about. And I'm totally into peer pressure. So it's all I'll focus on for this post.

2) In these posts, I'll be discussing the Fiscal Year 2012 budget. That is, the spending plan for October 2011 to October 2012 (federal Fiscal Years in the US go from October to October), or at least the one that was supposed to go from Oct 2011 to Oct 2012...there was a hitch-up...

You see, back in February 2011 the Obama administration suggested a rough outline Budget plan to the Congressional Democrats, and they presented a fleshed out version to the Congressional Republicans. All of Congress was then supposed to sit down, discuss the Budget, make their adjustments and edits, and finalize/enact it by October 2011.

They didn't. The Republicans refused the Democrat's spending plan outright and by early April had countered with an alternative Budget of their own. The Democrats refused to negotiate or accept many of the Republican's suggestions, and the Republican's refused to compromise on their counter proposal.

This led to the debt-ceiling crisis, the threat of technical default, and the failed Super Committee. Right now, the Federal Government continues to operate without a budget. Since October, we've been passing a bunch of temporary spending plans for specific programs, along with intermittent short extensions of last years Budget. We'll continue to do this until Congress can come to a compromise.

Now, a few of the Budget items have since been okayed for the year. But big chunks of the federal government still don't have a final budget for the year, are surviving on temporary injunctions, have budgets set to change during the year, or have otherwise uncertain funding.

Late Budgets are nothing new (in fact, the last time Congress managed to completely approve a budget by the standard October deadline was in 2006).

BUT, we usually manage to pass the budgets mostly all at once, in one shot in the end. This year, looks like the trend will be approving it piece by piece. And normally the hold ups are over just a few items. This time, it's over pretty much the whole thing.

So rather than try to sort the status of each budget item in this post, I’m just going to pretend that the Democrats 2011 plan was approved in October, flat out, and as it was originally presented. It'll make our analysis a lot less complicated and easier to follow, rather than me throwing a complicated addendum on every item that's just going to be obsolete a week later.

HOWEVER, this will make the exact dollar values stated in the post a bit inaccurate. By the time we finally DO have a Budget, I'm sure it won't look precisely the same as the originally proposed plan.

But I promise it ultimately will only be different by a few tens of billions here and there. Nothing about the budget debates is really expected to change the relative size of these items in 2012, just their absolute dollar amounts. What’s listed as the biggest items here will be the biggest ones for the year, even if how big they will be, exactly, is still up in the air.

AND THIS ONE IS SUPER IMPORTANT...

3) Please keep in mind that the President has absolutely no direct power in this field. Zilch. Nada. Zip. The Federal Government's taxation and spending plans are ENTIRELY controlled by the Congress. THE PRESIDENT HAS NO FINAL SAY OVER TAXATION, BORROWING AND/OR SPENDING.

The president can beg and he can demand. He can request and he can recommend. But he cannot DO a damn thing. I can't stress this enough. If you're unhappy with the story you're about to hear, don't winge about the White House. It's an incredibly inefficient way of catalyzing any change.

It's tantamount to picketing the chief of police's office because your unhappy with the city’s zoning code laws. You're close, but not quite where you need to be to see what you want done done.

(Side note: “911, what’s your emergency?” “HELP! There’s a McDonalds WAY to close to the park! Make it move!!” You think it would work? Now I’m curious to try it…)

Anyway! Yes, the president and the Congress are both part of the same national government (just like the cops and the city planner are both part of the city gov't). And yes, the president does have influence (imagine what an "I owe you one" from Obama can get you). And typically, the president does make Budget suggestions and proposals.

But Congress has absolutely no requirement to listen to the president's ideas. Your Senators and Representatives are the only ones directly responsible for the Budget, and they have the final say, not the presidents.

But Congress has absolutely no requirement to listen to the president's ideas. Your Senators and Representatives are the only ones directly responsible for the Budget, and they have the final say, not the presidents.

[Interesting side note: You hear a lot of "tax plans" coming from presidential candidates: Cain's 9-9-9, or Perry's Marginal/Flat system. These are pretty weird things for a presidential candidate to promise - since they literally are not able to make good on their pledge! If elected, they CANNOT, as president, enact any particular tax strategy. They can only ask nicely that the Congress adopt them.

In the event that Cain was to become president, for example, he could ask Congress to put his 9-9-9 into use. They might do so. Or they might change it, tweak it, or flat out refuse. But ultimately, it's 100% Congress's choice.]

Clerical Note

The Federal Government’s Budget in actuality contains thousands of individual items. But in these posts, I’m going to lump those items together into large groups. Then I'll discuss only those groups. By the end of this two-post series, you'll see the Budget slowly broken down into 30 major subdivisions.

Never fear, though. The overarching categories that I’m going to present are kinda the "industry standard" ones to report on. The 30 subdivisions of the Budget that I use here you'll see used in many other places, it's a common way of breaking Federal Budgets down. You won’t miss out on the general conversation due to the broad categories I’m going to use.

Ok, so with the clerical stuff out of the way, lets get on with the big show. Here it is folks. Your tax dollars at work.

THE BIG PICTURE

Let's say that you and I go out into the world and manage to find a guy who has never in his life heard of the “The Federal Government of the United States” (lucky fella).

Now imagine us giving him a copy of the Fed’s expense reports, receipts, spending plans, bank statements and budget...information JUST on its spending habits. "The money trail."

If we then were to ask the guy to look over all the financial activity of this "Federal Government of the United States" thingy and take a guess as to what that entity does…what would he say?

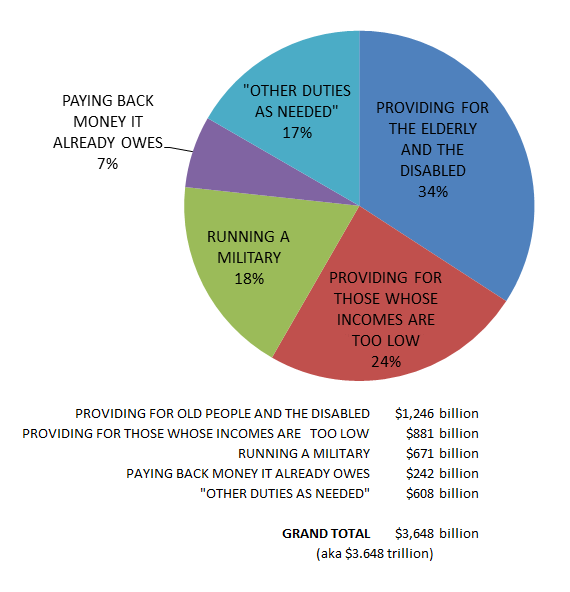

Well, looking only at the money trail, he could conclude that the US’s Federal Government only does five things:

1) Provides for the elderly and the disabled

2) Provides for those whose incomes are too low

3) Runs a military

4) Pays back money that it already owes

5) "Other duties as needed"

Chart expresses ALL spending activities of the US Federal Government.

Yup. That's it. Just 5 things.

And how much does it cost to get these 5 things done? $3.648 trillion.

So in FY 2012, the US Federal Government will need appx. $3.6 trillion to do all the things Congress wants it to do in FY 2012.

And how does a government raise $3.6 trillion? Two avenues exist: collecting taxes, and borrowing money.

In 2012, around $2.627 trillion will be collected in taxes from all American citizens and businesses (I say "around" because the exact amount of tax revenue the US government will collect in any given year is never completely known beforehand - you can learn more about that in my last few posts: 1 2 3).

So we already know right now that we're going to come up $1 trillion short over the course of the fiscal year.

In 2012, around $2.627 trillion will be collected in taxes from all American citizens and businesses (I say "around" because the exact amount of tax revenue the US government will collect in any given year is never completely known beforehand - you can learn more about that in my last few posts: 1 2 3).

So we already know right now that we're going to come up $1 trillion short over the course of the fiscal year.

And how will we close the $1 trillion “gap”? You guessed it. We're going to be taking out loans to cover the difference. (FYI - The gap itself is sometimes referred to as the budget "deficit." The money borrowed to cover that “deficit” is added to the "national debt," which is the total amount of all the debts the US is paying on right now. Essentially, it’s how far we are in the hole.)

In February 2011, the Obama administration proposed a $3.7 trillion Budget. Then the Congressional Democrat's suggested the above Budget, one that totals $3.6 trillion. The indignant Congressional Republicans threw an absolute snizzfit at this number and countered with their budget...one that totaled $3.5 trillion.

Now, to be fair, the Republican plan also had provision for some additional spending cuts over time, so the long-term difference was more than that little $.1 trillion. Still though, the fact that Congress couldn't even agree to just accept the original Budget right off the bat, let $.1 trillion slide for the time being, let government organizations do their job uninterrupted - and THEN start duking it out - is a bad sign. The entire political process tanked over $.1 trillion, just 3% of the total issue at large.

You can see why economists are getting worried about the government's financial behavior. Our financial problems are not unsolvable. But with a Congress so incredibly stalled, and so opposed to working together, no one has a lot of confidence that the tough decisions are going to be made anytime soon...

Ok, so there's your overview, the big picture. In Economystified's next post (which will be on 12/23) we'll look at the big five budget items a little closer, and I'll break those major five into the subsequent 30 items I promised you. But for now, just get yourself familiar with the concept's introduced here in Part One. Cuz in Part Two the real fun begins.

do you have a credible source for the numbers presented here?

ReplyDeleteunder the heading "Before we begin...", the 8th paragraph down, the one that starts "You see, back in February 2011 the Obama administration suggested a rough outline Budget plan", the words "Budget plan" is hyperlinked. it will take you to a pdf of the budget itself on the whitehouse home page.

ReplyDeletethe hyperlinks have all my citations, but if missed a number let me know and i'll give you the link

HOWEVER i would not get too hung up on this post. the budget debate going on right now is over the 2013 fiscal year budget, so a lot of this commentary is stale by now.

check out my post on the CURRENT budget proposal and debate here: http://economystified.blogspot.com/2012/02/2013-prelim-federal-budget.html